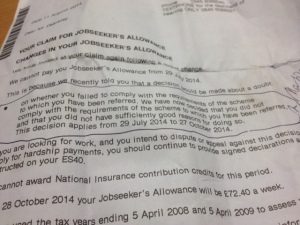

Gina, a single woman of 58 from the north-west of England, had been on WTC – a means tested payment for those in low-paid work – including self-employed people. It’s paid by HM Revenue and Customs (HMRC). Unfortunately Gina, who lost her beloved pet shop business in the recession, became very ill with depression. Following an assessment by ATOS, she was placed on employment and support allowance (ESA) in the work-related activity group. Because she was receiving WTC, this amount was deducted from her ESA to ensure she only got £100 per week.

She did her WTC return only to discover she was no longer entitled to it after 28 weeks off sick. She has now been told that she owes HMRC £732. ESA will not back date their reduced underpayments to cover this, saying she should have informed WTC directly when she went onto ESA. Gina says of this demand from the HMRC: “I was in no fit state to even feed myself let alone notify loads of different departments of my current status. I am now left with a debt of £732 for money I never received off the ESA. This is morally wrong and theft. Apparently this is happening to a lot of people on WTC who went onto ESA. Why are these departments not liaising and ensuring the claimants are aware of the rules? This is another way of sanctioning the vunerable.”

Gina wants the ESA to backdate her full benefit to the date the WTC ceased so that she can pay the WTC back from the reimbursed ESA underpayments. She adds: “I also want to raise awareness of how immoral this whole situation is. I am not asking for anything I was not entitled too. If I have to pay this back, it means I would have been only receiving £47 for three months instead of £100. It boils down to theft of benefits.”

She says of people who are ill and in her situation: “It’s ridiculous to have a debt you don’t really owe because you were underpaid ESA. How many people have been affected by this? It’s another form of sanction. I have worked all my life and to be in this position is abhorrent. I’ve written a letter to the HMRC telling them I can’t pay.”

Gina wrote to her local MP, Conservative David Morris, for help. He replied: “There is no scope for discretion within the law relating to Social Security, and that is something which we must all accept as fact, regardless of whether or not we agree with it. It has long been intrinsic within Social Security Legislation that the onus of responsibility to provide accurate information, details and documentation both at the outset of a claim, and at all stages thereafter, rests with the claimant. This would include therefore, reporting change of circumstances. The regulations say that it is your duty to report any change in your circumstances which you might be reasonably expected to know could affect your right to, the amount of, or the payment of, your benefits.

This is Regulation 32(1A) and (1B) of the Social Security (Claims and Payments) Regulations 1987. It is not the responsibility of any individual or Government Department to notify someone either that they are eligible to claim a particular benefit, or to take action on an assumption of a change of circumstances. If you fail to disclose a material fact which affects your entitlement, (whether unintentional or otherwise) then an overpayment will be deemed to have occurred. Such overpayments are then generally recoverable.”

She wrote back to Mr Morris telling him that she did not receive an overpayment. “The Government can’t have it both ways. I was underpaid my ESA. If I had been getting the full benefit for WTC and ESA I would have been overpaid. But this is not an overpayment as I did not get my full ESA entitlement! I don’t even want the money paid back to me but to go direct to HMRC clearing my ‘debt’. An inter department transfer.”. She continued: “The whole situation is theft and a sanction. I am sure you would not be happy if you were expected to lose seven weeks of your salary due to an honest mistake.”

Gina wants to know how many people have been affected by this issue. She added: “It’s just immoral. It’s a secret sanction. They’re not telling people what they need to do, yet they are very quick to penalize people for not doing it. I was bouncing back (from depression), but I’m not now. I’m worrying about money I’ve lost that I should have had. I’m not going to pay this. I refuse.”

She points out that when she applied for ESA she had to note on the claim form which benefits she was claiming and that she listed WTC. “So they would have had that information, they knew I was on it. Why wasn’t that automatically flagged on the system once I’d been on ESA for more than 28 weeks? The DWP should automatically send out a letter after 28 weeks to those on WTC informing them that they are now going to get full ESA and they will either inform WTC or you have to. Simple.”

Thanks to Gina for flagging up this issue. Please get in touch if you have had similar problems with WTC and ESA.